100% up to €500 + 200 FS

Casinoly Casino Greece

Το καζίνο Casinoly ιδρύθηκε το 2021 και λειτουργεί με άδεια από την αρχή του Κουρασάο. Ανήκει στον ισχυρό όμιλο τυχερών παιχνιδιών της Rabidi N.V..

Πρόκειται για ένα διαδικτυακό καζίνο, με το Casinoly Gr να συνδυάζει παιχνίδια καζίνο με αθλητικό στοίχημα. Έχει μια εντυπωσιακή ποικιλία με πάνω από 8.000 τίτλους σε κουλοχέρηδες, αλλά και εκατοντάδες τραπέζια live καζίνο.

Ιδιαίτερα θετική εντύπωση μας έκαναν οι προσφορές του Casinoly καζίνο, με τους παίκτες να μπορούν να έχουν μπόνους κατάθεσης σε εβδομαδιαία βάση. Στο καλωσόρισμα του Casinoly online καζίνο μπορείτε να επιλέξετε ανάμεσε σε μπόνους για το στοίχημα ή το καζίνο.

Η ιστοσελίδα Casinoly Ελλάδα είναι διαθέσιμη στην ελληνική γλώσσα και επικεντρώνεται στη θεματική της Αρχαίας Ρώμης με προσεγμένα γραφικά και σύμβολα από την ιστορική εποχή.

Σύνοψη του Καζίνο Casinoly

Κατά την αξιολόγηση Casinoly ξεχωρίσαμε βασικά χαρακτηριστικά της πλατφόρμας..

|

Έτος ίδρυσης |

2021 |

|

Άδεια λειτουργίας |

Κουρασάο |

|

Πάροχοι παιχνιδιών |

Pragmatic, NoLimit City, Hacksaw Gaming, Playtech, Yggdrasil, BGaming κ.α. |

|

Μπόνους εγγραφής |

100% έως 500€ + 200 Δωρεάν Περιστροφές στο καζίνο |

|

Ελάχιστη κατάθεση |

10€ |

|

Παιχνίδι από κινητό |

iOS & Android |

|

Υποστήριξη πελατών |

24/7 Live chat, email [email protected] |

Πλεονεκτήματα και Μειονεκτήματα Casinoly

Η Casinoly προσφέρει σημαντικά οφέλη στα μέλη της, όμως υπάρχουν και κάποια ζητήματα, που χρήζουν βελτίωσης και θα μπορούσαν να αναβαθμίσουν ακόμα περισσότερο το παιχνίδι.

|

Πλεονεκτήματα |

Μειονεκτήματα |

|

Κατάθεση/ανάληψη από 10€ |

Δεν έχει κατάθεση με Visa |

|

Ιστοσελίδα στα ελληνικά |

Δεν έχει εξυπηρέτηση στα ελληνικά |

|

Μεγάλη ποικιλία σε φρουτάκια |

|

|

24/7 εξυπηρέτηση πελατών |

Casinoly App

Το Casinoly app είναι ουσιαστικά ένας σελιδοδείκτης, ώστε να μπορούμε να έχουμε άμεση πρόσβαση στη Casinoly από την αρχική σελίδα της συσκευής μας. Έτσι, δεν χρειάζεται να αναζητήσετε κάποια Casinoly εφαρμογή για λήψη στο App Store ή το Google Play, αφού αρκεί η εγκατάσταση του σελιδοδείκτη μέσα από ένα πρόγραμμα περιήγησης.

Η εφαρμογή σας επιτρέπει παιχνίδι από παντού χωρίς Casinoly λήψη, ενώ σας βοηθάει με ειδοποιήσεις για προσφορές ή εύκολη σύνδεση με την εξυπηρέτηση πελατών του καζίνο.

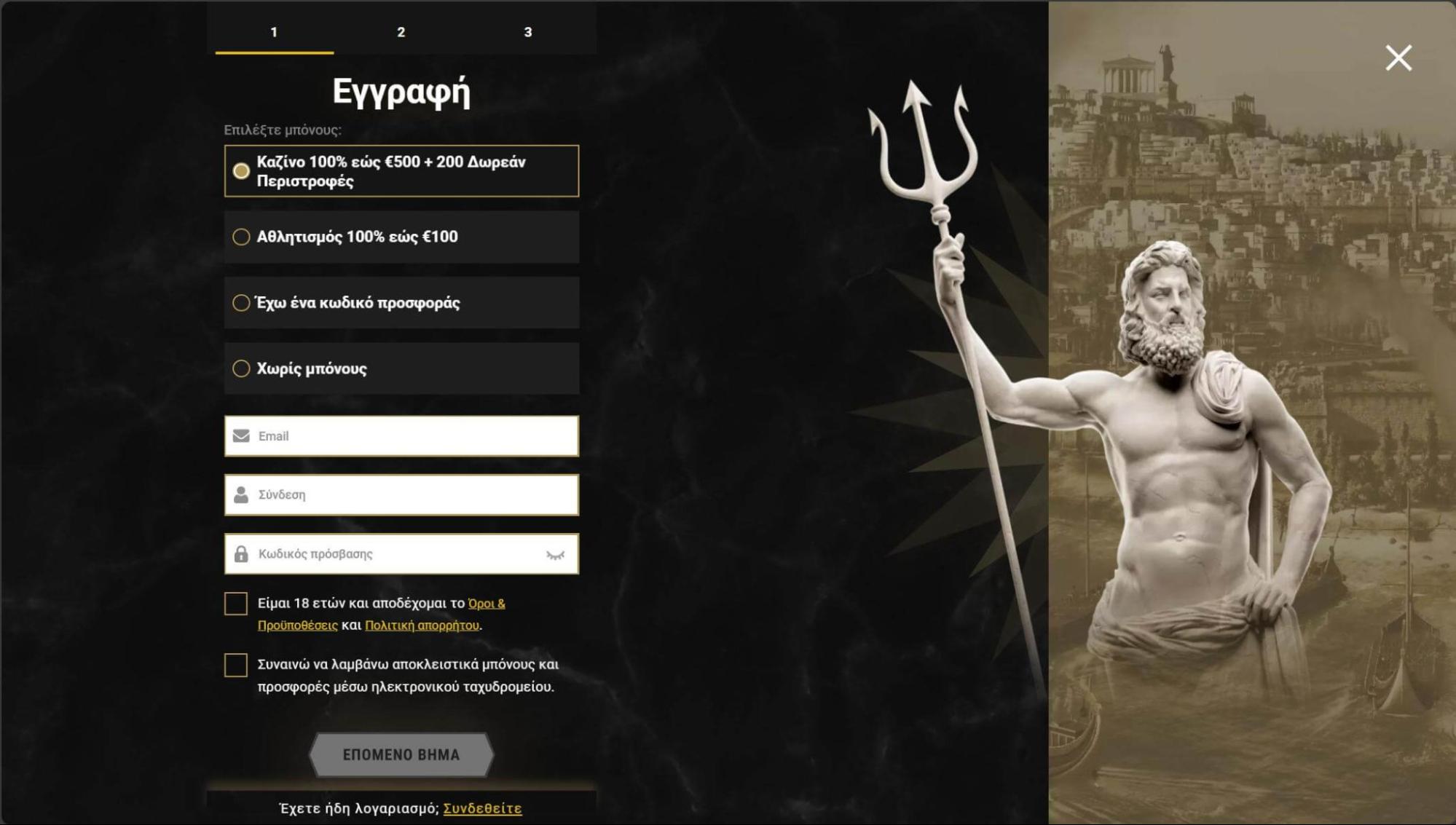

Εγγραφή και Είσοδος στο Casinoly

Η διαδικασία για την εγγραφή στη Casinoly είναι αρκετά εύκολη, ώστε να έχετε τη δυνατότητα να παίξετε σχεδόν άμεσα. Προχωρήστε ως εξής:

-

Ανοίξτε την ιστοσελίδα της Casinoly και πατήστε το κουμπί της εγγραφής.

- Επιλέξτε ένα από τα μπόνους καλωσορίσματος.

-

Ενημερώστε για το email σας και ορίστε όνομα χρήστη κωδικό ασφαλείας. Με αυτά θα γίνεται Casinoly login στη σελίδα.

- Πρέπει να δεχτείτε τους όρους και την πολιτική απορρήτου της Casinoly, αλλά και να δηλώστε πως είστε άνω των 18 ετών, ώστε να συνεχίσετε.

-

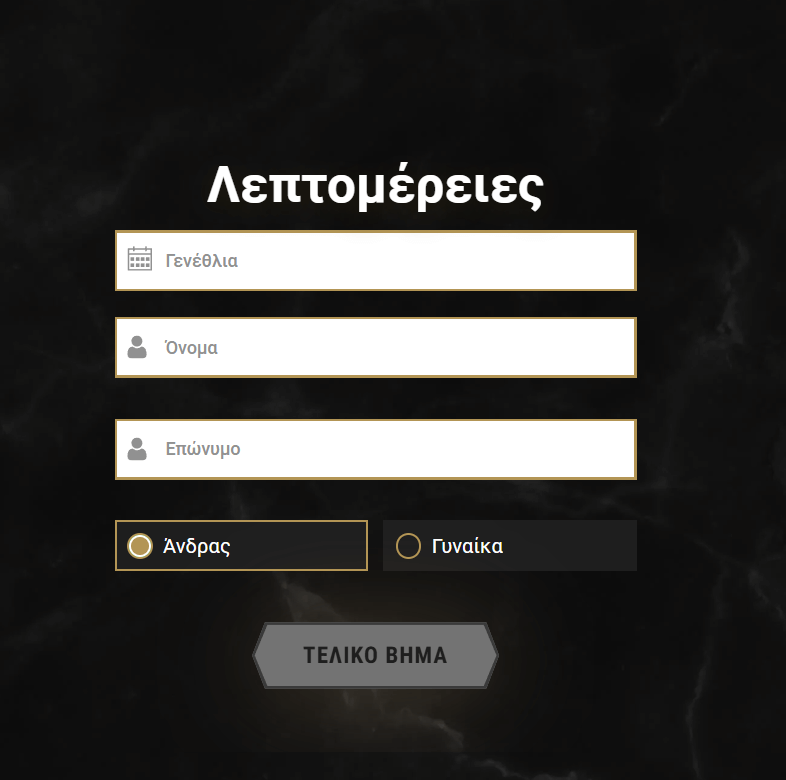

Στην τελική φόρμα πρέπει να ενημερώσετε για το ονοματεπώνυμο, το φύλλο και την ημερομηνία γέννησής σας.

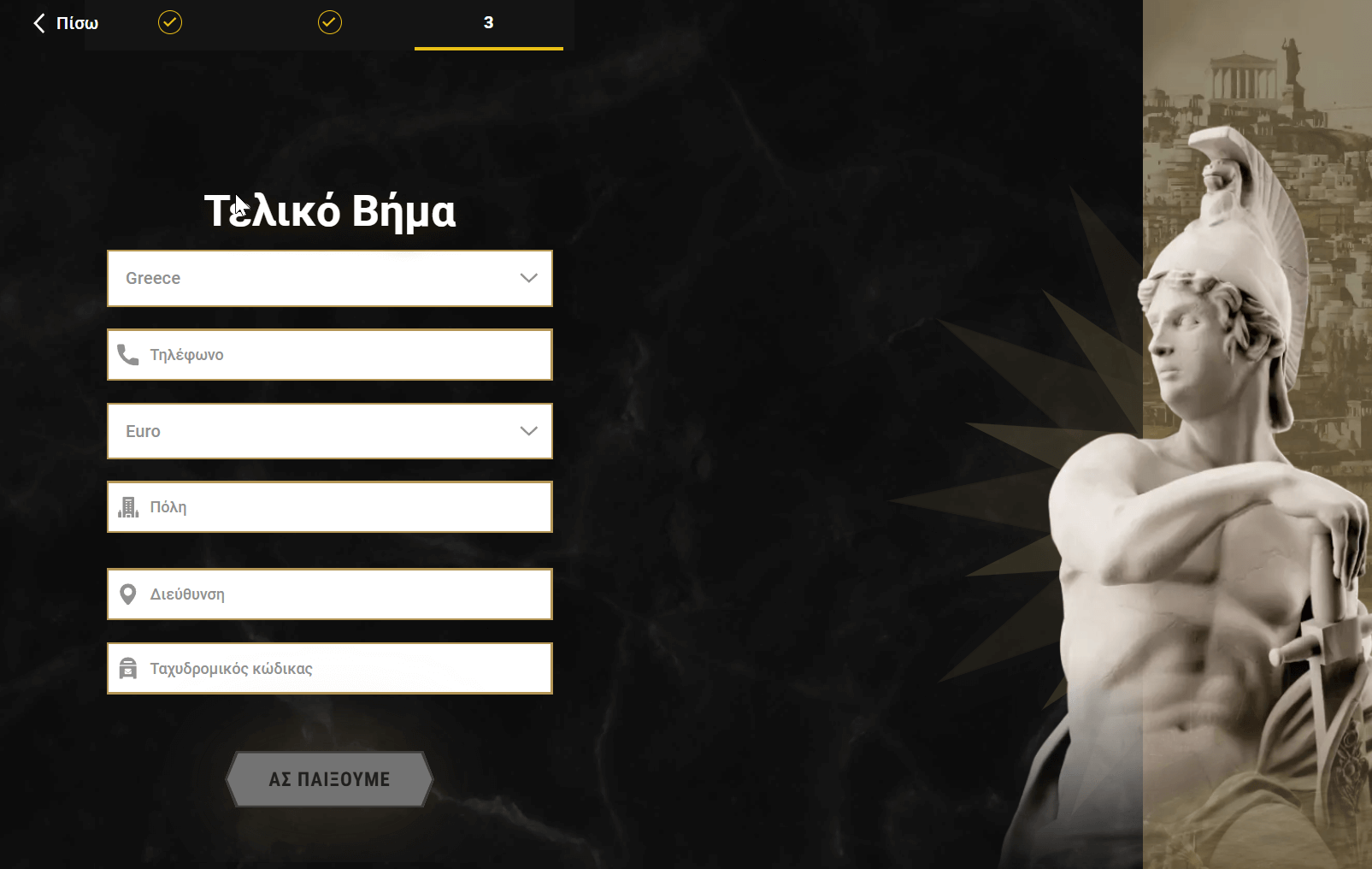

- Συμπληρώστε το κινητό σας τηλέφωνο, αλλά και αναλυτικά τα στοιχεία διεύθυνσής σας.

Αφού δημιουργήσετε τον λογαριασμό σας, η σύνδεση γίνεται συμπληρώνοντας το όνομα χρήστη και τον κωδικό πρόσβασης στα σχετικά πεδία του Casinoly casino login.

Casinoly Bonus

Η πλατφόρμα της Casinoly στηρίζει τους παίκτες της με μια ποικιλία προσφορών. Τα μπόνους αφορούν τους νέους, αλλά και τους παλαιότερους παίκτες του καζίνο, ώστε σε συχνή βάση να μπορείτε να ενισχύσετε το παιχνίδι σας.

Ξεχωρίζουμε τα γενναιόδωρα Casinoly μπόνους κατάθεσης στο στοίχημα (500€) και στο καζίνο (700€), ενώ σημαντικά οφέλη βλέπουμε να έχουν και οι χρήστες που έχουν φτάσει ψηλά στα επίπεδα VIP. Προσφορές Casinoly χωρίς κατάθεση και επιστροφές χρημάτων μπορούν πραγματικά να αναβαθμίσουν την εμπειρία σας στη σελίδα.

Μπόνους Καλωσορίσματος

Οι νέοι παίκτες της Casinoly έχουν τη δυνατότητα να επιλέξουν ανάμεσα σε δύο προσφορές καλωσορίσματος στη σελίδα. Ήδη από τη φόρμα της εγγραφής, αλλά και έπειτα (πριν την πρώτη κατάθεση), είναι διαθέσιμα δύο μπόνους κατάθεσης, είτε 100% έως 100€ στο στοίχημα, είτε 100% έως 500€ + 200 δωρεάν περιστροφές στο καζίνο.

Και οι δύο προσφορές συνοδεύονται από απαίτηση τζιραρίσματος 6x και 35x αντίστοιχα, ενώ τα κέρδη από τα free spins έχουν απαίτηση τζίρου 40x. Ελάχιστη κατάθεση είναι τα 20€.

Casinoly Promo Code

Δεν είναι συχνό φαινόμενο να συναντήσετε κάποιον Casinoly promo code. Η ιστοσελίδα έχει επιλέξει να μη λειτουργεί ιδιαίτερα με κωδικούς μπόνους, αφού η συμμετοχή στις περισσότερες προσφορές είτε γίνεται αυτόματα, είτε μπορείτε να δηλώσετε συμμετοχή με κάποιο σχετικό κουμπί. Ωστόσο, μπορεί να προκύψει κάποιος μπόνους κωδικός είτε προσωπικός ως επιβράβευσης VIP, είτε στο πλαίσιο κάποιας εξωτερικής προώθησης.

Πρόγραμμα VIP

Το πρόγραμμα επιβράβευσης της Casinoly αφορά τους πιο δραστήριους παίκτες στο στοίχημα και το καζίνο. Κάνοντας συχνές καταθέσεις και παίζοντας αρκετά, μπορείτε να ανεβείτε όλο και υψηλότερα στα πέντε επίπεδα VIP της εταιρείας. Όσο πιο ψηλά φτάσετε, τόσο μεγαλύτερα και τα οφέλη.

Πέρα από τις συχνές προσωπικές προσφορές, η εταιρεία σας δίνει και μια αυξανόμενη επιστροφή χρημάτων ανάλογα με το επίπεδό σας. Ακόμα, υπάρχει μεγαλύτερη ευελιξία στις αναλήψεις, ενώ μπορείτε να έχετε μέχρι και έναν προσωπικό διαχειριστή λογαριασμού.

Συγκεκριμένα, τα πέντε επίπεδα VIP του Casinoly παραπέμπουν στην Αρχαία Ρώμη και είναι τα παρακάτω:

- Πολίτης της Ρώμης

- Επικεφαλής

- Πατρίκιος

- Γερουσιαστής

- Αυτοκράτορας

Άλλες Casinoly Προσφορές

Τα μέλη της Casinoly έχουν τη δυνατότητα να αξιοποιήσουν αρκετές προσφορές σε εβδομαδιαία βάση. Μπορείτε να εξετάζετε τα διαθέσιμα μπόνους όποτε συνδέεστε στη σελίδα, αφού τα περισσότερα σχετίζονται με τις καταθέσεις στον λογαριασμό σας. Οι προσφορές που ξεχωρίσαμε στο διαδικτυακό καζίνο και το στοίχημα της Casinoly είναι οι παρακάτω:

- Μπόνους κατάθεσης στο στοίχημα 50% έως 500€

- Μπόνους κατάθεσης στο καζίνο 50% έως 700€ + 50 δωρεάν περιστροφές

- Δωρεάν περιστροφές με την κατάθεση

- Επιστροφές χρημάτων καζίνο (15% έως 3.000€), live καζίνο (25% έως 200€) και στοίχημα (10% έως 500€)

- Ενίσχυση παρολί στο στοίχημα

- Δωρεάν στοίχημα 100€

Παιχνίδια στο Casinoly

Η ποικιλία παιχνιδιών στο Casinoly είναι ένα από τα κύρια πλεονεκτήματα του Casinoly. Η σελίδα δίνει στους παίκτες πρόσβαση σε μία εντυπωσιακή γκάμα επιλογές. Οι περισσότεροι τίτλοι αφορούν φρουτάκια, όμως θα βρείτε και πολλές επιλογές σε παιχνίδια πρώιμης πληρωμής και επιτραπέζια RNG. Επιπλέον, αρκετά πλήρης είναι και η ενότητα του live καζίνο με τραπέζια με πραγματικούς κρουπιέρηδες.

Έτσι, καλύπτεται ευρεία ποικιλία, που μπορεί να καλύψει τις απαιτήσεις ενός απαιτητικού παίκτη καζίνο. Όποιο και αν είναι το γούστο σας, θα βρείτε κάποιο παιχνίδι να σας συναρπάζει στην ενότητα καζίνο της Casinoly.

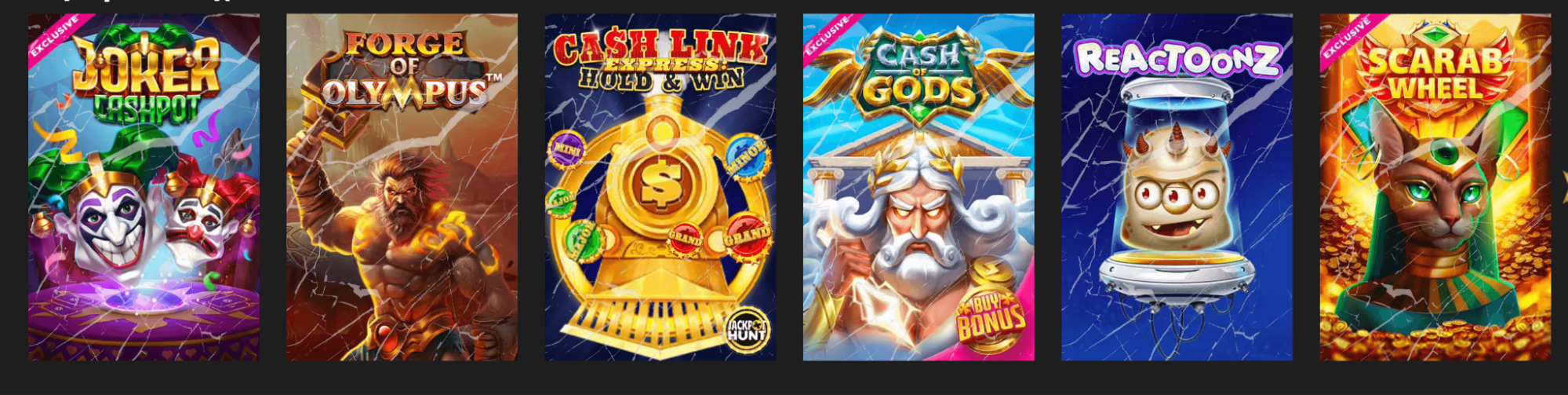

Κουλοχέρηδες

Τα φρουτάκια αποτελούν το βασικό προϊόν της Casinoly, αφού συναντάμε περισσότερους από 7.000 τίτλους παιχνιδιών στη βιβλιοθήκη της εταιρείας. Περιλαμβάνονται πολλοί δημοφιλείς τίτλοι σε κουλοχέρηδες, που είναι αγαπητοί στο κοινό της Ελλάδας. Ξεχωρίσαμε, μεταξύ άλλων, τα Reactoonz, Sugar Rush, Wanted Dead or A Wild, Book of Dead, 7x7 Zeus, Mental, Green Wizard, Midas Golden Touch και Pirots 3.

Υπάρχουν χρηστικοί τρόποι κατηγοριοποίησης των κουλοχέρηδων. Συνεπώς, μπορείτε να δείτε συγκεντρωμένα τα νέα φρουτάκια, κορυφαία και δημοφιλή, τίτλους τζάκποτ ή άλλες θεματικές, όπως τα αποκριάτικα, τα χριστουγεννιάτική ή τα πασχαλινά, ανάλογα με την εποχή του χρόνου.

Φρουτάκια Τζάκποτ

Στο καζίνο της Casinoly συναντάμε μια ξεχωριστή κατηγορία για τα φρουτάκια τζάκποτ, ώστε να δείτε τους κουλοχέρηδες με προοπτική μεγάλων νικών. Οι κουλοχέρηδες τζάκποτ προσφέρουν την πιθανότητα για μεγάλα ποσά μέσα από την επιπλέον λειτουργία τους. Υπάρχουν παιχνίδια με εσωτερικά τζάκποτ για κάθε παίκτη, αλλά και κάποια με προοδευτικά τζάκποτ, που αφορούν το σύνολο των παικτών.

Συναντήσαμε αρκετές αγαπημένες επιλογές σε παιχνίδια τζάκποτ, όπως τα Divine Fortune, 777 Strike, Piggy Riches, Gonzo’s Quest, Fortune Fish, Age of Gods και 40 Super Hot.

Άλλα Παιχνίδια

Πέρα από τα φρουτάκια, υπάρχουν και άλλα παιχνίδια με γεννήτρια τυχαίων αριθμών. Συναντάμε κάποια γρήγορα παιχνίδια, τύπου Plinko ή Aviatrix, τα οποία έχουν mini games με τη δυνατότητα cash out πρόωρα.

Επιπλέον, μπορείτε να δοκιμάσετε και αρκετά επιτραπέζια παιχνίδια καζίνο, όπου παίζετε απέναντι στον υπολογιστή. Υπάρχουν πολλές εκδόσεις μπακαρά, μπλάκτζακ, ρουλέτας, πόκερ και σχετικών τίτλων από κορυφαίους παρόχους.

Live Casino

Το ζωντανό καζίνο της Casinoly συνεργάζεται με κορυφαία στούντιο, που προσφέρουν μια μοναδική ατμόσφαιρα στο παιχνίδι σας. Παίζοντας σε τραπέζια των Evolution, Playtech, Bombay Live και Creedroomz, συναντάμε τραπέζια με αληθινούς ντίλερς. Μπορείτε να παίξετε μπλάκτζακ, ρουλέτα, μπακαρά και πόκερ σε πολλές παραλλαγές και με σημαντικό εύρος σε ελάχιστα και μέγιστα πονταρίσματα.

Επιπλέον, ξεχωρίσαμε πολλά αξιόλογα σόου παιχνιδιών, όπως τα Crazy Time, Monopoly Live, Football Studio Dice, Cash or Crash και Lightning Storm.

Πάροχοι Λογισμικού

Οι πάροχοι λογισμικού αποτελούν σημαντικό κεφάλαιο για το Casinoly, αφού δίνουν στην πλατφόρμα τη δυνατότητα να φιλοξενεί ποικιλία παιχνιδιών με διαφορετικό gameplay και χαρακτηριστικά. Το διαδικτυακό καζίνο συνεργάζεται με περισσότερους από 75 παρόχους λογισμικού, επιτρέποντας στους παίκτες να δοκιμάσουν πολλά και διαφορετικά φρουτάκια. Ξεχωρίζουμε γνωστά ονόματα στη λίστα του Casinoly, που είναι αρκετά αγαπητά στους Έλληνες παίκτες. Μεταξύ άλλων, στο καζίνο της Casinoly θα βρείτε κουλοχέρηδες των Pragmatic Play, Netent, Play’n Go, NoLimit City, Hacksaw Gaming, Red Tiger, Thunderkick και Playtech.

Μπορείτε να φιλτράρετε τα παιχνίδι στη βιβλιοθήκη της Casinoly και με βάση τον παροχο, ώστε να βλέπετε συγκεντρωμένες τις επιλογές του δημιουργού που σας αρέσει.

Casinoly Μέθοδοι Πληρωμής

Το καζίνο της Casinoly προσφέρει σημαντική ευελιξία σε μεθόδους πληρωμής, ώστε να μπορείτε να κάνετε καταθέσεις και αναλήψεις με αρκετούς τρόπους.

Στον παρακάτω πίνακα μπορείτε να δείτε τις διαθέσιμες επιλογές για συναλλαγές, αλλά και τα όρια της πλατφόρμας.

|

Μέθοδος Πληρωμής |

Ελάχιστη/Μέγιστη Κατάθεση |

Χρόνος Κατάθεσης |

Ελάχιστη/Μέγιστη Ανάληψη |

Χρόνος Ανάληψης |

Προμήθεια |

|

Mastercard |

10€/2.000€ |

Άμεσα |

10€/3.000€ |

Έως 48 ώρες |

- |

|

Visa |

- |

Άμεσα |

10€/3.000€ |

Έως 48 ώρες |

- |

|

Τραπεζικό Έμβασμα |

- |

Άμεσα |

10€/5.000€ |

Έως 5 ημέρες |

- |

|

Paysafecard |

10€/1.000€ |

Άμεσα |

- |

- |

- |

|

Skrill |

10€/5.000€ |

Άμεσα |

- |

- |

- |

|

Neteller |

10€/5.000€ |

Άμεσα |

- |

- |

- |

|

MiFinity |

10€/2.500€ |

Άμεσα |

10€/2.500€ |

Έως 48 ώρες |

- |

|

Binance |

10€/440€ |

Άμεσα |

10€/5.000€ |

Έως 24 ώρες |

- |

|

Bitcoin Cash |

10€/5.000€ |

Άμεσα |

10€/5.000€ |

Έως 24 ώρες |

- |

|

Tether |

10€/5.000€ |

Άμεσα |

10€/5.000€ |

Έως 24 ώρες |

- |

|

Bitcoin |

30€/5.000€ |

Άμεσα |

40€/5.000€ |

Έως 24 ώρες |

- |

|

Litecoin |

10€/5.000€ |

Άμεσα |

10€/5.000€ |

Έως 24 ώρες |

- |

|

Ethereum |

10€/5.000€ |

Άμεσα |

10€/5.000€ |

Έως 24 ώρες |

- |

|

Ripple |

10€/5.000€ |

Άμεσα |

10€/5.000€ |

Έως 24 ώρες |

- |

|

USDC |

10€/5.000€ |

Άμεσα |

10€/5.000€ |

Έως 24 ώρες |

- |

Εφαρμογή Κινητού

Το καζίνο Casinoly mobile δεν έχει λανσάρει ακόμα κάποια εξειδικευμένη εφαρμογή για κινητά τηλέφωνα, τουλάχιστον όχι κάποια που να μπορείτε να κατεβάσετε από τα ηλεκτρονικά καταστήματα του App Store για iOS και Google Play για Android. Το παιχνίδι είναι φυσικά εφικτό μέσα από το πρόγραμμα περιήγησης της συσκευής σας. Αρκεί να συνδεθείτε στην πλατφόρμα με κάποιο browser. Όλα τα δημοφιλή προγράμματα, όπως Google Chrome, Mozilla Firefox, Safari και Opera θα σας εξυπηρετήσουν στο παιχνίδι στη Casinoly.

Πάντως, υπάρχει η δυνατότητα δημιουργίας σελιδοδείκτη, ώστε να έχετε άμεση πρόσβαση στο περιβάλλον της σελίδας και να απολαμβάνετε το παιχνίδι από όπου κι αν βρίσκεστε μέσω smartphone ή τάμπλετ.

Casinoly Άδεια και Ασφάλεια

Το Casinoly είναι ένα νόμιμο και ασφαλές καζίνο, αφού λειτουργεί με άδεια από την αρχή παιγνίων του Κουρασάο. Πρόκειται για μια έγκυρη ρυθμιστική αρχή, που ασχολείται με τον έλεγχο της ασφάλειας, αλλά και του δίκαιου παιχνιδιού σε πλατφόρμες τυχερών παιχνιδιών. Η άδεια έχει βγει στο όνομα της ιδιοκτήτριας εταιρείας, Rabidi N.V., η οποία έχει σημαντικό κύρος στον χώρο. Έχει γνωστές και βραβευμένες σελίδες, κάτι που ενισχύει και την αξιοπιστία του Casinoly.

Η επιτροπή αδειοδότησης εξετάζει το καθεστώς ασφαλείας της πλατφόρμας. Πρέπει να υπάρχει η απαιτούμενη κρυπτογράφηση, ώστε να είναι ασφαλή τα προσωπικά σας στοιχεία, αλλά και οι πληροφορίες συναλλαγών σας. Επιπλέον, θεμελιώνεται το δίκαιο παιχνίδι με την παρουσία γεννήτριας τυχαίων αριθμών.

Εξυπηρέτηση Πελατών

Το τμήμα εξυπηρέτησης πελατών της Casinoly είναι αρμόδιο για τη συνδρομή σε οποιοδήποτε ζήτημα αντιμετωπίζουν οι παίκτες. Μάλιστα, μπορείτε να έρθετε επαφή με την υποστήριξη ακόμα και αν δεν έχετε ακόμα δημιουργήσει τον λογαριασμό σας στο Casinoly.

Υπάρχουν δύο βασικοί τρόποι για επικοινωνία με την ομάδα εξυπηρέτησης. Αρκετά πρακτικό είναι το Casinoly live chat, αφού μέσα σε ελάχιστο χρόνο ένας εκπρόσωπος θα επικοινωνήσει μαζί σας. Αν δεν θέλετε να επικοινωνήσετε μέσα από την ιστοσελίδα, μπορείτε απλά να στείλετε ένα email στην ηλεκτρονική διεύθυνση [email protected], ώστε να έρθει η απάντηση εκεί.

Πέρα από την επικοινωνία, μπορείτε να ρίξετε και μια ματιά στην ενότητα συχνών ερωτήσεων της σελίδας. Υπάρχουν απαντήσεις σε δημοφιλή ερωτήματα των παικτών, ώστε να ενημερωθείτε γρήγορα.

Casinoly Κριτικές

Οι παίκτες από την Ελλάδα και το εξωτερικό φαίνεται να είναι ιδιαίτερα ικανοποιημένοι από τις παροχές του Casinoly, αλλά και γενικά από τη συμπεριφορά του καζίνο. Πολύ θετικές αξιολογήσεις στο Casinoly Trustpilot και άλλες σελίδες υπάρχουν για τη συχνότητα των μπόνους, αλλά και για τη μεγάλη ποικιλία των παιχνιδιών. Τα μόνα παράπονα έχουν να κάνουν με μικρές καθυστερήσεις στις αναλήψεις, που αφορούν κυρίως συναλλαγές σε μεγάλα χρηματικά ποσά.